Accounting for Carriage Cost, Discounts, Sales Tax

Accounting for Specialised Transactions

1. Carriage costs

Carriage and delivery charges on non-current assets are included with the cost of the non-current asset, and are debited to that non-current asset’s account, along with the cost of the item. But carriage charges on the purchase and sale of goods in which the organisation trades are recorded separately as follows.

- Carriage outwards . This is carriage paid by the organisation on goods that it sells. It is debited to a separate ‘ carriage outwards ’ ledger account, and treated as any other expense, that is, it is transferred to the income statement at the end of the period.

- Carriage inwards . This is carriage paid by the organisation on goods that it buys. It is debited to a separate ‘ carriage inwards ’ ledger account. However, some purchases may have the carriage costs paid for by the supplier, and these costs will be included in the purchase price. This creates a situation where the purchases account is debited with some items already containing an element of carriage costs, and some that do not. So that all purchases are treated in the same way, the carriage costs borne by the organisation itself are transferred into the trading account at the end of the period, and added to the cost of purchases.

2. Discounts

A discount is a reduction in the amount paid for goods and services. Discounts may be received fromTrade discounts. A trade discount may be offered to customers who are also traders, which is where the term ‘ trade discount ’originates. However, nowadays it might be offered for a variety of other reasons, such as to existing customers, new customers, customers buying in bulk and so on. Once the discount has been offered, it cannot be taken away for whatever reason, so it simply means that a lower price is being charged. Trade discount is deducted from the quoted price (sometimes referred to as a ‘ list ’ price, or a ‘ catalogue ’ price), and only the net amount is recorded in the ledger accounts.

Visit My YouTube Channel :

- Zikir Penghapus Dosa, Pembuka Pintu Rezeki, Penenang Hati, Permudah Segala Urusan

- Punya Hajat Dunia dan Akhirat? Pengen Bisnis Lancar? | Udah Sholawatin Aja!!

- Sholawat Munjiyat - Ust. Yusuf Mansyur

Example:

On 1 January, AB buys goods for resale on credit from XY, with a list price of $250, subject to trade discount of 20 per cent. The trade discount is $50, and therefore the net amount payable is $200. The purchases account is debited with $200, and the account of XY is credited with $200.

Note: Once this net figure has been agreed, any further calculations (see below for cash discounts and sales tax) are based on the net figure.

Cash discounts. A cash discount may be offered to encourage prompt payment. The term used to apply only to payments made in cash at the time of sale, but nowadays it applies to payments by many different methods, provided that payment is made within a certain time. If the payment is not made within that time, the discount is withdrawn.

The difficulty is that, at the time of sale, it will not be known whether the payment will be made in time (unless, of course, it is made at once), but the transaction still needs to be entered in the ledger accounts. Thus, at the time of sale, no account is taken of the cash discount.

Example:

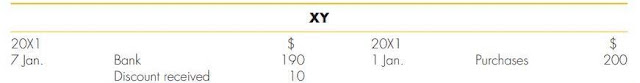

Continuing with Example, suppose that XY also offers cash discount of 5 per cent for payment within ten days. At the time of purchase, AB is not certain to pay within the 10 days, so the transaction is entered ignoring the cash discount (but after adjusting for the trade discount). The ledger accounts would appear as follows:

If the account is not settled in the 10 days, the full amount of $200 is payable.

Let us suppose, however, that AB pays on 7 January. Five per cent is deductible, so only $190 is paid (by cheque). The bank account will be credited with $190, and the account of XY will be debited.

The account has been settled, and yet there is still a balance of $10 credit in the ledger account, which gives the impression that there is still $10 owing to XY. This is not the case. The account needs to be cleared, to give a true impression, by debiting it with a further $10, and a credit is made to ‘discounts received ’ account. This account is a form of revenue, and will be transferred to the income statement at the end of the period, to increase profit.

The ledger accounts after recording the cash discount are as follows:

Cash discount allowed will arise where an organisation allows its customers to deduct an amount for prompt payment. The receivables account will be credited with the discount, and a ‘discounts allowed ’ account will be debited. The balance on this is treated like any other expense and transferred to the income statement at the end of the period.

Accounting for Sales Tax

In this section we shall use the generic name ‘ sales tax ’ . As a consequence the amount that they charge their customers for goods and services supplied will increase by the addition of sales tax.

The rate of sales tax varies between countries and will also vary between the nature of the goods and services supplied. The sales tax collected does not belong to the organisation that charges and collects it and the tax must therefore be remitted to the tax authorities on a regular basis. It is a tax that ultimately must be paid to the tax authorities. Because it does not belong to the organisation collecting it, it does not affect the value of its sales. However, it does mean that customers will have to pay to the organisation the full amount, including sales tax.

The organisation may also have to pay sales tax itself on goods and services that it buys. This sales tax paid can normally be reclaimed. Even though the organisation has to pay the supplier the full amount, if the sales tax is reclaimable then it does not affect the value of the item purchased.

Such organisations will, as a consequence, be both receiving and paying sales tax. The organisation may offset sales tax paid against the sales tax received from customers, and only the difference is payable to/by the tax authority. The sales tax paid to suppliers is therefore an asset (receivable) and the amount received from customers is a liability (payable), until they are offset when a net asset or (more likely) a net liability arises.

Sales tax received can be referred to as ‘ output ’sales tax, and sales tax paid can be referred to as ‘ input ’ sales tax.

The double-entry bookkeeping records need to show the goods and sales tax values separately so that the purchases, expenses and sales are posted net (i.e. without the addition of sales tax) and the sales tax amounts are posted to a separate sales tax account.

Exercise 1:

During October, W had the following credit transactions:

1 Oct. Purchased goods from H $360 subject to 20 per cent trade discount

3 Oct. Sold goods to HG for $80

5 Oct. Sold goods to PL for $15

8 Oct. Bought goods from KJ for $4,000 subject to 10 per cent trade discount

12 Oct. Received a credit note from KJ for goods returned valued at $1,200 list price

15 Oct. Sold goods to RW for $2,000

18 Oct. Issued credit note for $500 to RW for goods returned

All of these transactions are subject to sales tax at the rate of 17.5 per cent.

The balance on the account is now $212.28 debit, which signifies that a refund of this amount is due from the tax authorities. This amount will be shown as a current asset on the statement of financial position at 31 October.

Input sales tax is the sales tax that an organisation suffers on the goods and services that it buys. It can normally be reclaimed from the tax authorities. It does not contribute towards the cost of the goods and services.

Output sales tax is the sales tax that an organisation must add to the goods and services that it sells. It must pay over this sales tax to the tax authorities. It does not contribute to the sales revenue earned by the organisation.

The treatment of sales tax in the accounts is as follows:

- Input sales tax is debited to the sales tax account (or to a separate sales tax input account, if required). The value of the goods purchased is debited to the relevant account, while the total of the invoice is credited to the payables account until paid.

- Output sales tax is credited to the sales tax account (or to a separate sales tax output account). The value of the goods sold is credited to the sales account, while the total of the invoice is debited to the receivables account, until paid.

- Sales tax on goods returned is debited or credited to the sales tax account as appropriate: for returns inwards the sales tax account is debited, for returns outwards it is credited.

- The balance on the sales tax account is shown as an asset (if a debit balance) or a liability (if a credit balance) on the statement of financial position. A credit balance must be paid over to the tax authorities while a debit balance can be reclaimed.

- Inventories are valued, excluding sales tax.

1. Sales tax on non-current assets and expenses

Input sales tax is also suffered on the purchase of non-current assets and expenses, and can be reclaimed in the normal way. There are, however, generally some items on which input sales tax cannot be reclaimed, although the detail will vary between countries. Examples in the UK are:

- Sales tax on passenger cars;

- Sales tax on entertainment expenses.

In both the above cases, the sales tax cannot be reclaimed, so it is included with the cost of the item. For example, the purchase of a passenger car, costing $10,000, plus sales tax of 17.5 per cent, in effect costs $11,750, and so the motor cars account would be debited with that amount.

2. Sales tax in separate ledger accounts

When completing the sales tax return to the tax authorities, it is necessary to provide separate totals of input and output sales tax. Therefore, some organisations may keep separate ledger accounts for these.

3. Non-registered businesses

Some businesses may not be required to account for sales tax; this may be because of their small size or because of the nature of the goods/services they provide. Such businesses are referred to as ‘ non-registered ’businesses for sales tax purposes. In this case, they are not allowed to add sales tax to their sales, but on the other hand they cannot reclaim the sales tax on their purchases, either. Thus, where input sales tax is paid it is included with the cost of the item in the ledger accounts.

For example, if a non-registered business purchases goods costing $100, plus sales tax at 17.5 per cent, it will debit the purchases account with the full $117.50.

4. Zero-rated and exempt supplies

Supplies of some goods and services are zero-rated , which means that although they are taxable, the rate used is zero. Common examples in the UK include basic foodstuffs and children’s clothing. Businesses that make such supplies add zero sales tax to their outputs, but are still able to reclaim the sales tax on inputs in full.

Yet other goods and services are exempt from sales tax. Businesses supplying such goods cannot reclaim the sales tax on their inputs.

Consider three businesses: A, B and C. All three make monthly cash sales of $10,000, before adding any applicable sales tax. Company A’s supplies are all standard-rated, B’s supplies are all zero-rated and C’s supplies are all exempt. All three make monthly cash purchases of $4,000, plus sales tax at 17.5 per cent. Their results for a month will be as follows:

You can see that C is at a disadvantage compared with A and B. This is because it has suffered sales tax that he cannot reclaim. This will affect its profit. A and B can both reclaim their sales tax, so their profit is not affected by the charging or suffering of sales tax.

A and B’s profit can be calculated as sales (excluding sales tax), minus purchases (excluding sales tax), that is, $10,000 $4,000 $6,000, whereas C’s profit is sales minus purchases (including sales tax), that is $10,000 $4,700 $5,300.

Comments

Post a Comment